What is a Holding Company?

A holding company is a business entity designed to own and manage the assets or stocks of other companies. Unlike operational companies that produce goods or services, holding companies exist primarily to control other companies, referred to as subsidiaries. This structure allows for centralized management, streamlined operations, and enhanced strategic oversight.

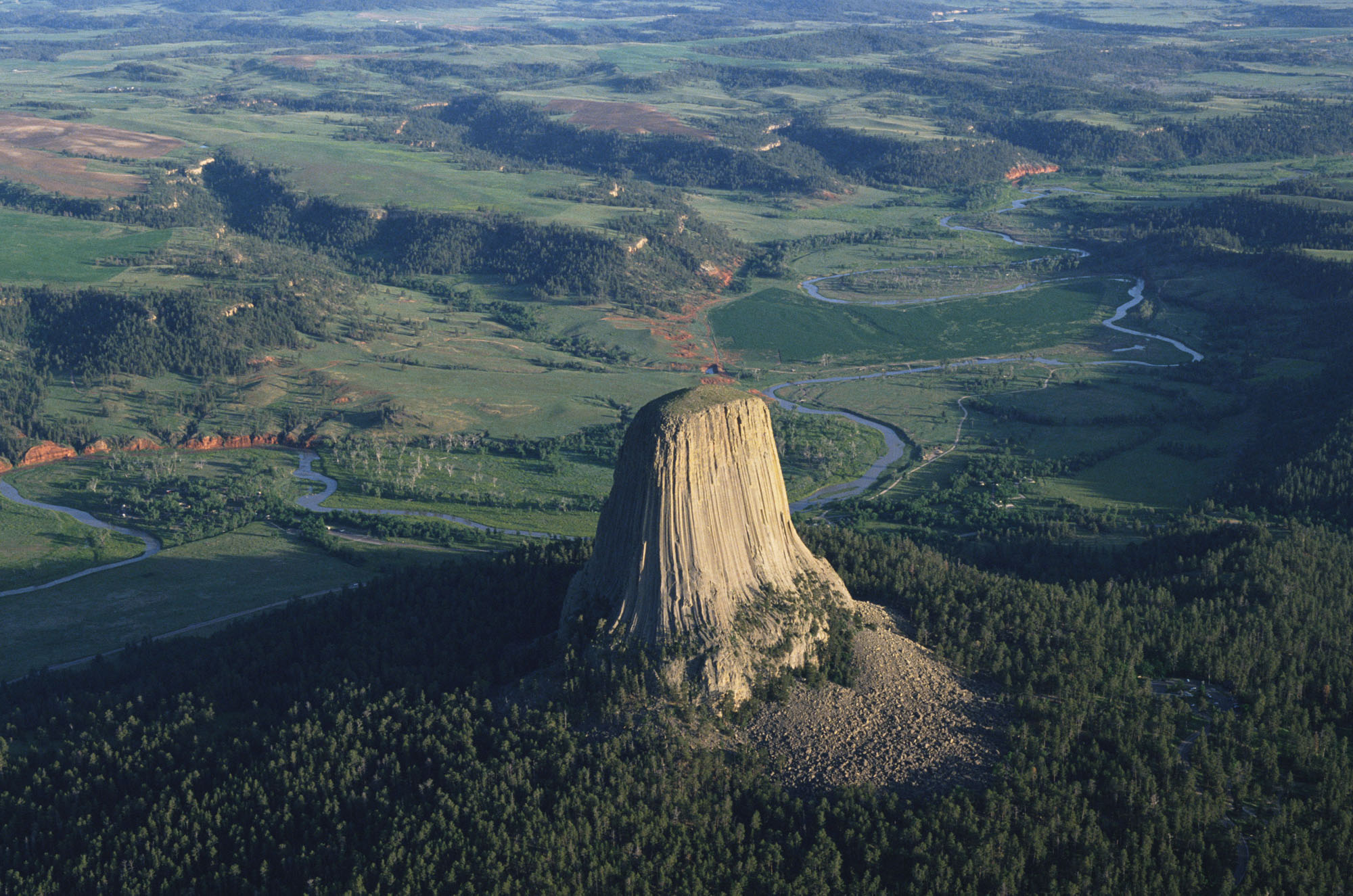

Why Consider a Wyoming Holding LLC?

Choosing the right jurisdiction for your holding company is crucial. The state of Wyoming has become a preferred choice for many business owners due to its robust legal protections, privacy benefits, and favorable tax environment.

Limited Liability and Asset Protection

Wyoming LLCs offer unparalleled asset protection and limited liability, making them a top choice for business owners. The state's strong legal statutes, including specific protections for single-member LLCs, ensure that owners are shielded from personal liability. This means that personal assets are protected from business creditors and lawsuits.

It is crucial to have comprehensive protection from both sides: ensuring your personal assets are safeguarded from potential claims by tenants and shielding your business from personal creditors in the event of a lawsuit.

Privacy

Wyoming places a high value on the privacy of LLC members. By hiring a Wyoming registered agent, members can keep their personal information, including their names, off public records. This level of privacy helps protect against data breaches and makes it difficult for others to easily determine the extent of a member's assets through state websites.

Tax Advantages

Pass-Through Taxation

One of the significant tax benefits of a Wyoming LLC is its pass-through taxation. This means that the LLC itself is not taxed on its profits. Instead, profits are passed directly to the members and taxed as personal income. Given that Wyoming has no state personal income tax, this can result in substantial tax savings.

Flexible Tax Options

Wyoming LLCs also benefit from flexible tax options. Individual LLCs under a holding company become "disregarded entities" for tax purposes, meaning they do not need to file separate tax returns. Instead, all income and expenses are consolidated into the holding company's tax return, making the process cheaper and easier.

Could a Wyoming Holding LLC be Right for You?

Establishing a holding LLC in Wyoming offers substantial benefits, including enhanced asset protection, privacy, tax advantages, and low maintenance costs. These features make Wyoming an ideal jurisdiction for business owners looking to safeguard their investments and simplify their operations. If this sounds appealing, Safebook can help match you with the right accountant with expertise in this area to assist you and your business.

June 12, 2024

June 11, 2024

June 10, 2024